Fair Value Services for Fixed Income Portfolios

Axiom Valuation is a leading provider of recurring fair value reviews of fixed income portfolios held by hedge funds, Business Development Corporations (BDCs), and Collateralized Loan Obligations (CLOs). Properly fair valuing illiquid fixed-income instruments requires a unique combination of experience in the professional fixed-income market, and powerful analytics that incorporate all of the factors that enter the fixed-income pricing equation. We have developed a powerful, scalable, and cost-effective platform that enables our staff to deliver accurate and fully-documented fair value review reports to our clients to meet their demanding schedules for financial reporting. Our process has been vetted by the top audit firms, and has been found to yield results that meet established fair value guidelines at price points well below our competitors.

Portfolio Fair Value Services for CLO, BDC, and Other Fixed Income Entities

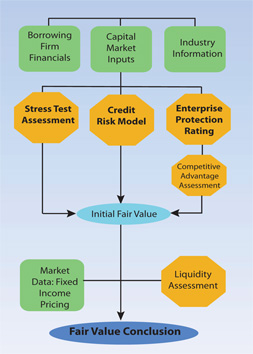

This diagram outlines our proprietary platform for fixed income fair value pricing.

Our empirical analysis is further informed by fixed income market data from LoanX, Markit, Reuters, FNRA, and Bloomberg. Our system includes extensive internal consistency checks, and then all reports are reviewed by members of our senior team. Axiom Valuation is the leader in fair value transparency.