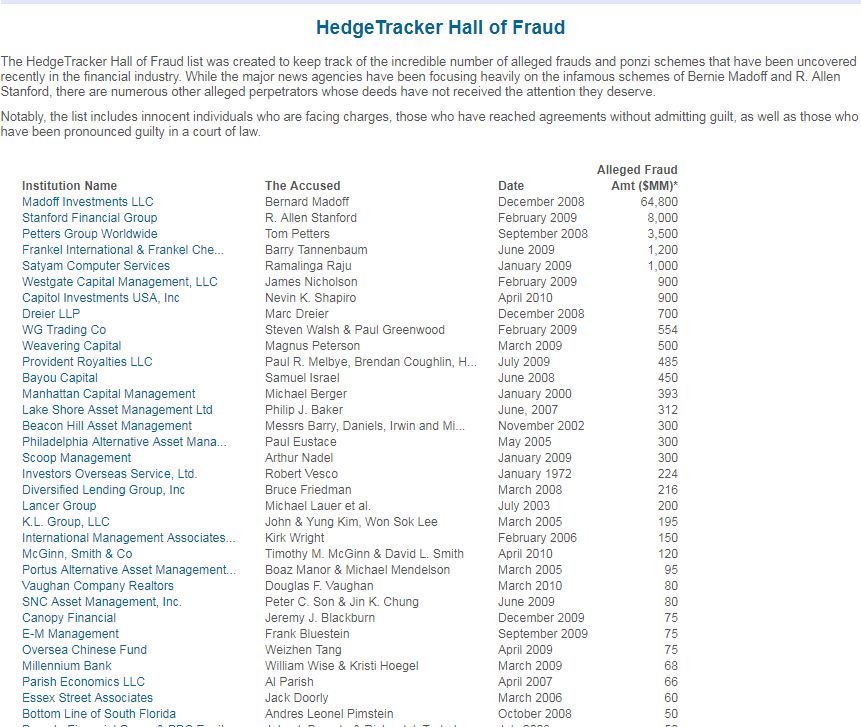

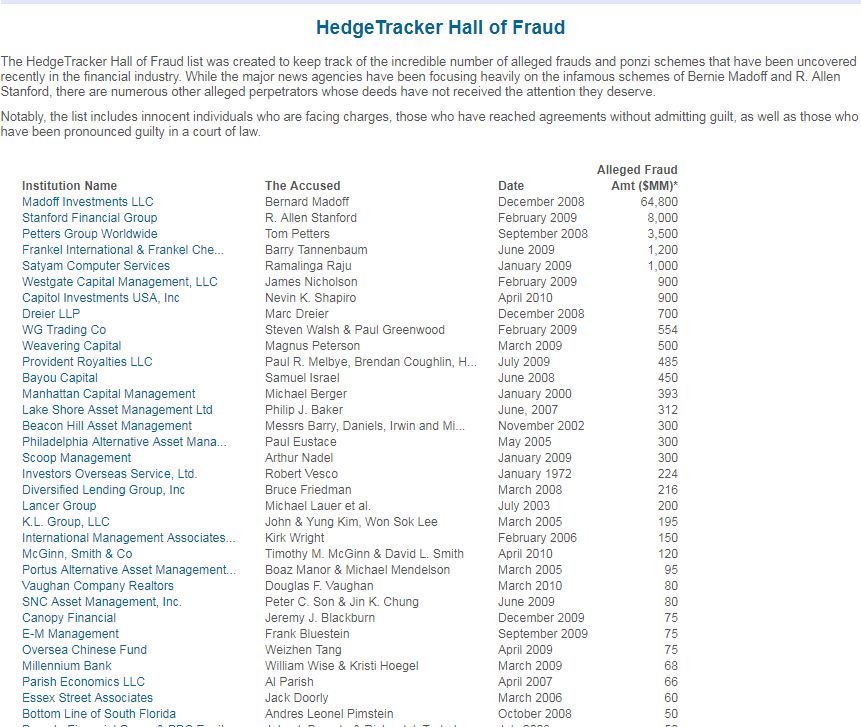

Everyone has heard of the Madoff and Allen Stanford headline cases, but how common is fraud within the hedge fund community? It appears that fraud is much more prevalent than you might think. Below is a table with the top hedge funds by value recently accused of fraud or Ponzi schemes. Some have been convicted, some are still facing charges, and some have reached agreements without admitting guilt.

Hedgetracker.com lists over 90 funds recently involved in fraud or Ponzi schemes.

It is more important than ever to make sure that you are properly vetting and monitoring your alternative investments. Part of that process should be AIRAS (Alternative Investment Return Authentication Service), a unique capability that tests empirically whether alternative investment self-reported returns are aligned with fund-specific information disclosed to investors. AIRAS is designed to provide low cost analytical audit support consistent with AICPA requirements and warn against potential malfeasance.

How accurate are hedge fund reported returns? Should you trust the manager reported returns and NAVs for the hedge funds held by your clients? An academic study forthcoming in the Journal of Financial Economics and currently an NBER working paper sheds some interesting light on this question. Steven Brown at NYU, William Goetzmann at Yale, Bing Liang at UMass, and Christopher Schwartz at UCal Irvine have looked at this problem in their paper “Trust and Delegation”. After analyzing the due diligence reports for 444 hedge funds between 2003 and 2008, they found that 42% of the funds had “noted verification problems”!

In the area of returns, 14% of the funds had performance disagreement, meaning that the manager reported return differed from the return reported by the administrator or auditor or it could not be verified. Asset disagreement was found in 19% of the funds, where the assets held did not agree with the administrator or auditor or could not be verified.

This has a number of implications for your endowment, foundation, or retirement funds who hold hedge funds. Most notably, you may not be able to trust the returns and NAVs reported by your hedge fund managers.

The AIRAS product is a cost effective way to ensure that self-reported returns and NAVs are not fraudulently stated, without going through the considerable cost of a due diligence report.

Hedgetracker.com lists over 90 funds recently involved in fraud or Ponzi schemes.

It is more important than ever to make sure that you are properly vetting and monitoring your alternative investments. Part of that process should be AIRAS (Alternative Investment Return Authentication Service), a unique capability that tests empirically whether alternative investment self-reported returns are aligned with fund-specific information disclosed to investors. AIRAS is designed to provide low cost analytical audit support consistent with AICPA requirements and warn against potential malfeasance.

How accurate are hedge fund reported returns? Should you trust the manager reported returns and NAVs for the hedge funds held by your clients? An academic study forthcoming in the Journal of Financial Economics and currently an NBER working paper sheds some interesting light on this question. Steven Brown at NYU, William Goetzmann at Yale, Bing Liang at UMass, and Christopher Schwartz at UCal Irvine have looked at this problem in their paper “Trust and Delegation”. After analyzing the due diligence reports for 444 hedge funds between 2003 and 2008, they found that 42% of the funds had “noted verification problems”!

In the area of returns, 14% of the funds had performance disagreement, meaning that the manager reported return differed from the return reported by the administrator or auditor or it could not be verified. Asset disagreement was found in 19% of the funds, where the assets held did not agree with the administrator or auditor or could not be verified.

This has a number of implications for your endowment, foundation, or retirement funds who hold hedge funds. Most notably, you may not be able to trust the returns and NAVs reported by your hedge fund managers.

The AIRAS product is a cost effective way to ensure that self-reported returns and NAVs are not fraudulently stated, without going through the considerable cost of a due diligence report.