Recent academic studies show that Alternative Investment returns are systematically misreported. In a study by Phalippou and Gottschalg (2009), a key finding that is relevant for fiduciaries is that a large part of the investment performance reported by PE funds is attributable to inflated accounting valuations applied to the Net Asset Values (NAVs) of the underlying assets.

In a search for returns, endowments, foundations, and retirement funds are increasingly investing in private equity funds. How can one be sure that the returns and NAVs reported by the fund are accurate and at fair value?

AIRAS is a statistical detective tool using Modern Portfolio Theory designed to provide a level of confidence that your Private Equity manager reported returns and NAVs are being reported properly. Using an unbiased statistical process, AIRAS assesses the feasibility of the fund attaining the reported return and determines whether the NAV reported by the manager is at fair value.

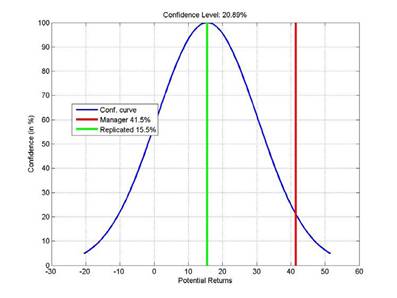

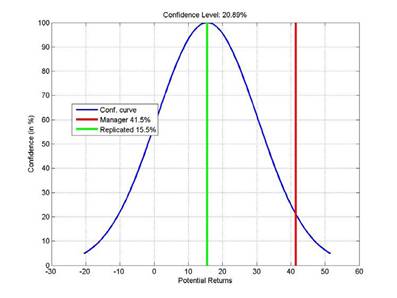

Below is an example from an actual AIRAS private equity report where the fund initially reported returns that seemed to be accurate and at fair value, but over time the confidence as calculated by the AIRAS product, declined to 20%. The result was that the client exited the fund.

In a search for returns, endowments, foundations, and retirement funds are increasingly investing in private equity funds. How can one be sure that the returns and NAVs reported by the fund are accurate and at fair value?

AIRAS is a statistical detective tool using Modern Portfolio Theory designed to provide a level of confidence that your Private Equity manager reported returns and NAVs are being reported properly. Using an unbiased statistical process, AIRAS assesses the feasibility of the fund attaining the reported return and determines whether the NAV reported by the manager is at fair value.

Below is an example from an actual AIRAS private equity report where the fund initially reported returns that seemed to be accurate and at fair value, but over time the confidence as calculated by the AIRAS product, declined to 20%. The result was that the client exited the fund.